– Enterprice Registration Certificate

– Company Charter

Operating

Lease

- Service

- Operating Lease

What is Operating Lease?

Operating lease is a form of operating lease, whereby BSL leases the asset to the Lessee for use for a certain period of time on the principle of returning the asset at the end of the lease term. BSL owns the leased asset throughout the lease term. The Lessee uses the leased asset and pays rent throughout the lease term according to the provisions of the operating lease contract.

Assets that can be leased in form of operating lease from BSL

Movable assets that serve the operations of the enterprise, from office automation machinery, information technology devices, vehicles to other types of assets used for the enterprise’s production and business.

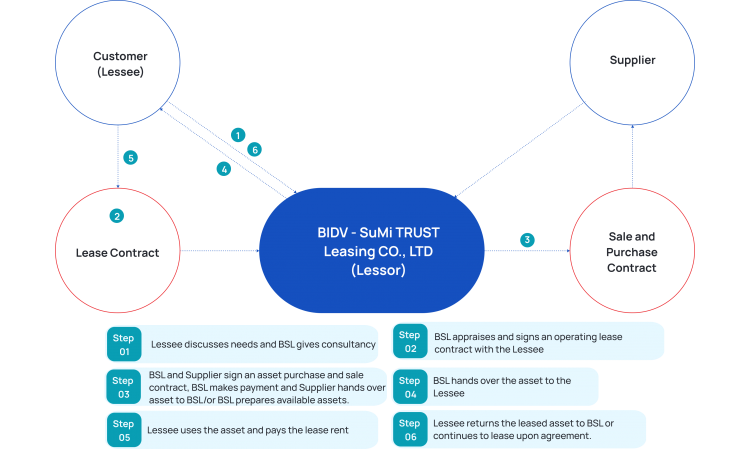

Process

Dossiers

Legal Documents

Financial Documents

Financial Statement (audited or tax report) of the latest 02 years and the last quarter (including notes to financial statement).

Project Documents

– Documentation proving the legality and validity of the asset investment plan and supplier selection (e.g., resolutions of the Board of Directors or decisions of the owner of the enterprise regarding the financial leasing plan and supplier selection).

– Business plan/Capital utilization plan/ Asset documents.

Comparison with Finance Lease

| Finance Lease | Operating Lease | |

| 1. Similar | ||

| 1.1. Ownership of the leased assets | Ownership belongs to the lessor throughout the lease term | |

| 1.2. Right to use leased assets | Usage rights belong to the customer (lessee) | |

| 1.3. Beneficiary of insurance for leased assets | Lessor | |

| 1.4. Continue to lease | The lessee has the right to choose to continue to lease the leased assets after the initial lease term | |

| 2. Differences | ||

| 2.1. Nature of leasing | Provide medium and long-term credit | Ordinary leased assets |

| 2.2. Lease term | A length of the lease term equal to the majority of the asset’s useful life | Usually shorter than the useful life of the asset, which can be days, months, quarters, years or per product unit… |

| 2.3. Lease amount | includes principal debt (the money the lessor spends to buy the leased assets) and interest rate, which are clearly specified in each part of the lease contract. | is a certain amount of money paid periodically |

| 2.4. Record of leased assets in financial statements |

The lessee records financial leased assets as fixed assets/long-term assets of the lessee on the balance sheet. Lessor: recorded off-balance sheet |

Lessee: recorded off-balance sheet The lessor records operating lease assets as the lessor’s assets on the balance sheet. |

| 2.5. Depreciation on leased assets | The lessee depreciates the leased assets according to regulations of the Ministry of Finance similar to the case where the lessee purchases the asset itself. In case the lessee commits not to repurchase the asset at the time of signing the lease contract, the lessee is entitled to depreciate the leased asset over the lease term. | The lessor depreciates the leased assets. The lessee records operating expenses |

| 2.6. Risk to assets | The lessee bears all risks | The lessor bears all risks |

| 2.7. Maintenance, servicing, repair and insurance | The lessee bears all these costs | Depending on the agreement, the lessor bears all these costs |

| 2.8. Option to purchase the leased asset after the end of the lease contract | The lessee has the priority right to choose to buy back the leased asset after the lease term at a nominal value, much lower than the original asset value. | The lessee does not have the priority right to choose to buy back the leased asset after the lease term. In case the lessee wants to buy back the leased asset, the lessor and the lessee will negotiate the liquidation price of the asset at the market price. |

Other products

Take a look!

Here are some suggestions for you.

Process

Dossiers

Legal Documents

- Enterprice Registration Certificate

- Company Charter

- Resolution on appointing management positions of the company

Financial Documents

- Financial Statement (audited or tax report) of the latest 02 years and the last quarter (including notes to financial statement)

- Bank statement for the last 6 month, VAT, information of Receivables; Payables, Inventory, Long-term assetss; Debt obligation

Project Documents

- Project license (if any)

- Meeting minutes and resolution/decision on the selection of finance lease and supplier

- Investment plan for leased assets

- Assets purchase memorandum with the supplier or the quotation from the supplier