News

- News

- Leasing Industry Expected to Grow by 18 – 20%

Leasing Industry Expected to Grow by 18 – 20%

The leasing sector is projected to grow by approximately 18 – 20% in 2025, with a focus on transportation vehicles, new technology production lines, and office equipment. The overarching direction is to increase green credit, support enterprises and business households in achieving sustainable and eco-friendly development.

Financial Leasing Sector Sees Strong Growth in 2024 but Faces Challenges

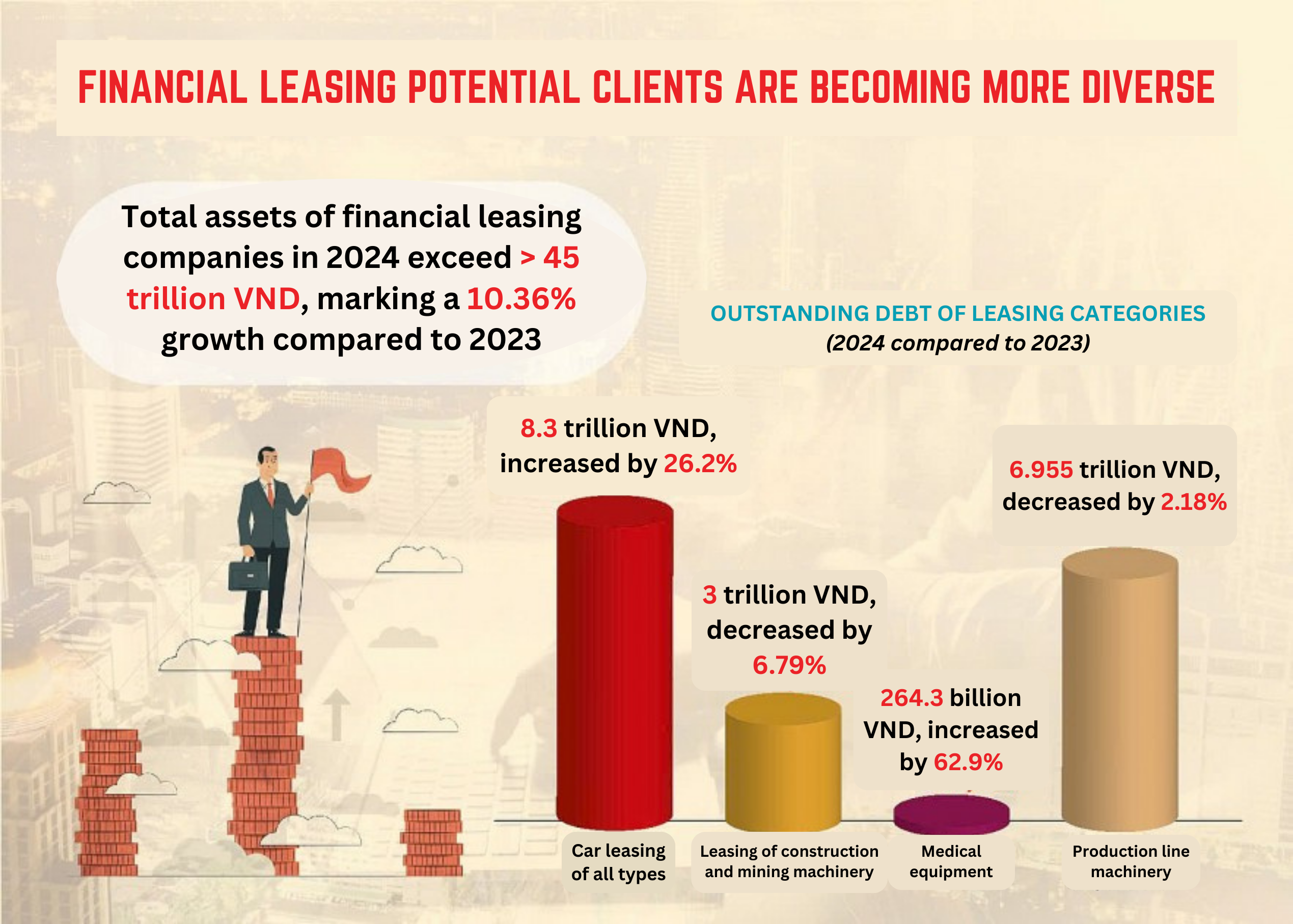

The total assets of member companies exceeded VND 45 trillion, marking a 10.36% increase compared to 2023. Total mobilized capital reached VND 23.4 trillion, growing by 18.1% year-on-year, with a mobilization growth rate 1.5 times higher than the overall banking system. Leasing outstanding loans consistently increased quarter by quarter, with 9,669 leasing contracts signed throughout the year, up 15.8% compared to 2023.

Notably, the leasing market has been diversifying. Car leasing reached an outstanding loan balance of VND 8.3 trillion, up 26.2% from the end of 2023. Leasing of construction and mining machinery amounted to VND 3 trillion, a decline of 6.79%. Medical equipment leasing stood at VND 264.3 billion, growing by 62.9%, while manufacturing production line leasing remained stable at VND 6.955 trillion, slightly down by 2.18% from the end of 2023.

Commenting on these results, Mr. Pham Xuan Hoe, Vice Chairman and General Secretary of the Vietnam Leasing Association, noted that 2024 was a challenging year for the Vietnamese economy, affecting both businesses and business households. Despite strong economic growth, the primary drivers remained the FDI sector, exports, and public investment. Meanwhile, private sector investment grew at a low rate, and consumption had yet to recover to pre-pandemic levels, highlighting the ongoing difficulties faced by businesses and consumers.

However, due to the government’s commitment and the State Bank of Vietnam’s (SBV) bold measures in lowering policy interest rates and increasing credit supply, Vietnam’s GDP growth exceeded 7%. Consequently, the leasing sector also witnessed several positive developments.

Nevertheless, the struggles of businesses and business households were reflected in certain figures within the leasing industry. The total outstanding leasing debt of member companies reached VND 40.5 trillion, up 8.6% from the end of 2023, accounting for more than 50% of the overall credit system’s growth. Some leasing companies had to focus on debt resolution and restructuring their customer and industry portfolios.

The non-performing loan (NPL) ratio was controlled at an average of 1.68% at the end of 2024, an increase of 0.68 percentage points from 2023. The total risk provision fund rose sharply by nearly VND 200 billion, up 75.2% year-on-year, reflecting the significant difficulties businesses and business households faced. Due to high provisioning, member companies’ pre-tax income declined by 24.33% compared to 2023.

2025 Could Pose Greater Challenges

Looking ahead to 2025, Mr. Pham Xuan Hoe predicts that economic difficulties could be twice as severe as in recent years. Geopolitical conflicts remain tense, and trade wars are escalating, leading to global economic uncertainty. These factors will impact consumption, production, exports, exchange rates, and ultimately, inflation in Vietnam.

These challenges will place considerable pressure on economic policy management, including monetary and fiscal policies, as well as government-led supply- and demand-side growth strategies, compounding Vietnam’s internal economic difficulties.

On a positive note, the former Director of the Banking Strategy Institute highlighted Vietnam’s advantages in export-oriented industries, foreign direct investment (FDI) attraction, and growing confidence among businesses and citizens in the government’s economic policies. Additionally, General Secretary To Lam’s directives to remove institutional bottlenecks, innovate legal frameworks, and enhance government efficiency will play a crucial role in supporting economic resilience.

Among the key policy measures the government is implementing, Mr. Hoe emphasized the importance of promoting credit growth and accelerating public investment. Large-scale infrastructure projects currently underway will have widespread economic ripple effects, particularly benefiting the construction sector, thereby creating momentum for leasing development.

Given these circumstances, the VILEA projects that leasing outstanding loans will grow by an average of 18 – 20% in 2025, with some companies having even greater growth potential.

Key areas of focus for the VILEA in 2025 include leasing for production lines, leasing of new technology equipment, and office equipment leasing for small and medium-sized enterprises (SMEs). A major advantage for the leasing sector is the increasing emphasis on green finance and sustainable consumption, aligning with the industry’s long-term development goals.

In 2025, VILEA member companies will prioritize implementing the SBV Governor’s directive on resolving non-performing loans and debt recovery, aiming to generate extraordinary income and reduce provisioning requirements.

Additionally, a major objective of the association is to work closely with regulatory authorities to address institutional barriers, thereby establishing a more favorable and internationally aligned legal framework for sustainable leasing growth.

Addressing Institutional Bottlenecks in Leasing

Recognizing that 2025 will continue to pose significant economic challenges for the leasing sector and the broader business community, the Vietnam Leasing Association urges member companies to proactively analyze the market, industry trends, and innovate their business models to ensure safe and effective leasing growth, despite Vietnam’s promising economic prospects for the sector.

Regarding regulatory improvements, the VILEA aims to collaborate with member companies and policymakers to resolve institutional constraints hindering leasing operations.

Key issues include the excessively high 30-day liquidity ratio (20% – Point c, Clause 3, Article 14, Circular 23/2020/TT-NHNN of the State Bank of Vietnam), which does not align with the operational characteristics of leasing companies.

Additionally, the requirement to report related-party information when granting credit is not suitable for leasing transactions. Specifically, Clause 4, Article 3 of Circular 15/2023/TT-NHNN (dated December 5, 2023) and Decision No. 573/QD-NHNN (dated March 29, 2024) require reporting of related-party information for credit transactions exceeding 0.5% of the non-bank institution’s charter capital.

The VILEA will also seek solutions to regulatory hurdles in registering, renewing, and changing the license plates of leased vehicles, particularly as the Ministry of Public Security amends Circular 79/2024/TT-BCA (Clause 2, Article 3).

(Source: Vietnam Leasing Association – Ngành cho thuê tài chính dự kiến tăng trưởng 18 – 20%)

My Hoang