News

- News

- BSL Organized Personal Finance Class for Children

BSL Organized Personal Finance Class for Children

In response to the “National Financial Inclusion Strategy by 2025” and with the support and interest from the leadership and members of the company, in November, the Corporate Strategy Department and the Legal & Compliance Department of BIDV-SuMi TRUST Financial Leasing Company (BSL) collaborated to organize a “Personal Finance” class for the children of BSL’s staff. The goal is to provide them with financial knowledge, helping them develop effective personal finance management skills.

The “Personal Finance Class for Children” has attracted the interest of parents and kids

A Proper Understanding of “Money”

At the beginning of the class, Mr. Ha Duyen Tung Duong – a Senior Associate from the Corporate Strategy Department – posed a simple question to the students: “What did you use your lucky money for?” This elicited many responses from the children, such as buying toys, purchasing school supplies, helping their mothers go shopping, and saving in a piggy bank, etc. Through this icebreaker question and a short animated video, the teacher helped the kids understand the concept of money, why it is needed, and the different forms of money in a lively, simple, and easy-to-understand manner.

After understanding what money is, the young students learned to distinguish between the concepts of “needs” and “wants” and how to “consider choices” through situational questions and a shopping game where they received a small amount of money to buy items at the “BSL Supermarket.” Faced with many choices, from school supplies to recreational toys, Dung Anh (9 years old) shared: “With the 650 dong I was given, I used 250 dong to buy a pen and 200 dong for a notebook, which are the ‘needed’ items for studying. The remaining 200 dong I spent on 2 small toys, which are the ‘wanted’ items for fun and entertainment.”

Spending and Saving Plans

During the spending lesson, the teacher divided the class into two small groups to discuss and plan the food expenses for two people over two days while their parents were away, with a budget of 200,000 dong. The teacher and parents were pleasantly surprised by the groups’ highly reasonable spending plans, which ensured nutritious meals while still leaving a small amount of money to save.

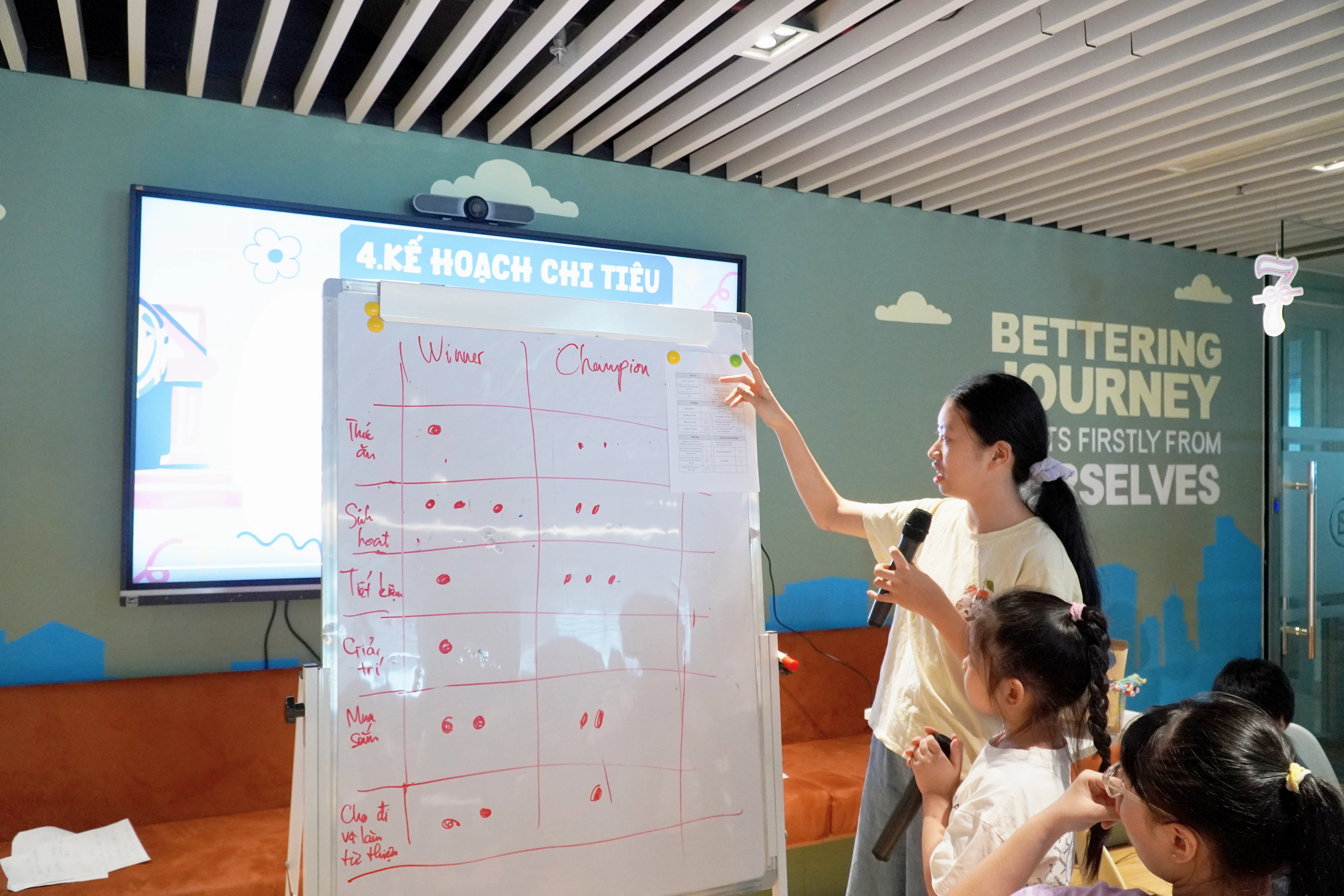

The groups discussed their spending plans

At the end of the class, the participants were divided into groups to carry out an activity of distributing 10 beans into 6 hypothetical spending jars. Each group proposed different allocation methods; some prioritized living expenses, while others focused on saving.

Ngọc Quyên, representing her group, shared: “To save 3 beans for living expenses, our group limited spending on unnecessary activities like entertainment or personal shopping. Instead, we will hang out with friends for free, donate old clothes, and spend just enough on essential needs. The remaining beans will be saved for emergencies in case of illness.”

Representatives from each group presented their spending and savings plans

Personal Finance Management – A Skill for Everyone, Not Just Adults

“Previously, parents often thought that children didn’t understand much about money, so they didn’t allow them to have much exposure to it. As society has developed, through the internet, children now have the opportunity to learn about money and personal finance issues. However, the information available online can be misleading, and parents cannot always monitor it, so having children participate in a personal finance management class is truly beneficial. The children learn the concept of money, the various forms of currency, as well as how to manage spending and saving, which helps them develop skills in managing money and personal assets, make smart decisions, and implement plans seriously. Not only do the children get to play and learn, but the parents themselves also gain valuable experiences to avoid being deceived by malicious individuals seeking to scam them out of money.” said Ms. My, a parent of Tâm An (12 years old).

The “Personal Finance Class for Children” was organized with the aim of providing financial knowledge to equip young learners with a stronger foundation in personal finance management. This will help them develop good habits such as reasonable spending, saving, investing, and valuing the worth of labor.

Thao Nguyen