News

- Insights

- Positive signals in 2024 create momentum for the Financial Leasing strong development

Positive signals in 2024 create momentum for the Financial Leasing strong development

With its optimal characteristics that cater to the needs of businesses, Financial Leasing is considered as a “gateway of opportunity” for enterprises, especially small and medium-sized enterprises (SMEs), to invest in their long-term capacity and resources.

2024 prospects create momentum for the development of Financial Leasing

Public investment continues to be strongly promoted as a driving force for private sector growth and also as an opportunity for the development of financial leasing services. According to the Financial Magazine, the obstacles and difficulties of public investment projects have been identified, and solutions are being sought to overcome them. The government is providing close guidance to ensure the progress of public investment activities in 2024. The disbursement results of public investment capital in January 2024 reached 16,900 billion VND (equivalent to 2.58% of the Prime Minister’s assigned plan).

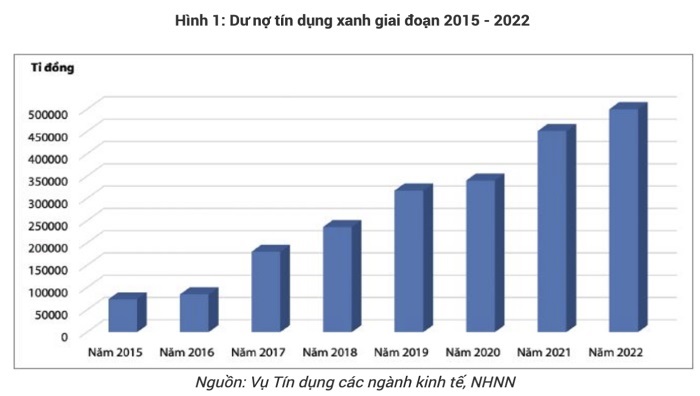

The green economy, the circular economy, require a significant amount of green credit and green bonds from financial institutions, including financial leasing. Considered as the “lifeblood” of green development, the green credit sources of financial institutions continue to expand through projects such as wind power, solar power, and circular economy projects in the textile industry, and more (according to the Business Forum).

Source: https://diendandoanhnghiep.vn/tang-nang-luc-cho-he-thong-ngan-hang-thuc-day-tin-dung-xanh-259060.html

Vietnam continues to be a destination for many foreign direct investment (FDI) enterprises, which are already familiar with financial leasing services. This is a signal that financial leasing still has a large potential for development. According to the Financial Magazine, factors such as political stability, rapid economic recovery after the pandemic, effective inflation control, and macroeconomic stability are contributing to Vietnam’s attractiveness in attracting FDI.

The outstanding advantages of financial leasing compared to traditional borrowing

Considered a market with significant development potential, Financial Leasing has four key advantages that are highly suitable for the current context, especially for SMEs, startups, and individual production and business households.

Firstly, Financial Leasing does not require collateral with a financing ratio of up to 100% of the leased asset value. Financial Leasing is considered as one of the optimal methods for businesses to easily access capital, as the financing can reach up to 100% of the leased asset value without requiring collateral.

In addition, Financial Leasing also offers sale and leaseback services that help businesses supplement their working capital for production and business activities. Businesses can sell their operating machinery and equipment to a financial leasing company and then lease them back for long-term use. This enables businesses to unlock the value of their assets and utilize them while maintaining operational continuity.

Secondly, Financial Leasing provides direct financing through the asset itself. Offering long-term credit directly through machinery and equipment to businesses helps prevent misuse or economic bubbles in the economy.

Thirdly, Financial Leasing helps businesses utilize their capital structure effectively and diversify their sources of funding. In addition, the clear payment schedule with flexible options in the Financial Leasing contract allows businesses to proactively plan their business strategies and manage cash flow efficiently.

Fourthly, using Financial Leasing products does not affect the credit limit of banks. With the strength of high financing ratios, no collateral requirements, and flexible lease terms, businesses can efficiently leverage various sources of funding while maintaining their credit limit at the bank.

BSL is a reputable financial leasing company in Vietnam. With the support from two leading financial institutions in Vietnam and Japan, BIDV and SuMi TRUST Bank, BSL provides professional financial leasing solutions for Vietnamese businesses. In 2023, BSL achieved a credit growth of ~27%, surpassing the average growth rate of both financial leasing companies (13.75%) and the entire banking industry (13.5%).

Businesses show great interest in Financial Leasing (Image source: BSL)

Thao Nguyen